By Lianne Kolirin

Labour’s proposed plan for VAT on independent school fees is causing “real anxiety” for parents at private faith schools, an online briefing by the Religion Media Centre was told.

The debate was the first of a series to focus on how religion is part of the overall general election story. A third of all schools have a faith foundation and experts from across the education and faith spectrum joined the online discussion, which covered a broad array of issues, including shared concerns over funding and teacher shortages.

There was particular disquiet at the impact of a tax rise on smaller private schools with a religious foundation. Private school fees at present do not include VAT because of a legal exemption for education bodies. But Labour plans to introduce the 20 per cent tax.

Such a move could have a “disproportionate” impact on faith schools within the private sector, according to Rudi Eliott-Lockhart, chief executive officer at the Independent Schools Association.

He told the panel there were just over 2,500 schools in the “incredibly diverse” independent sector and that his association represented about 660 head teachers who hail from the “more diverse types of independent schools”. While some are historically tied to the church and “wear their religion quite lightly”, there are many where religion vital to their character.

When asked how the heads of such independent schools felt about the proposed tax, Mr Eliott-Lockhart replied: “There’s real anxiety. Adding 20 per cent of VAT to these is going to have a huge impact on lots of schools.”

Such schools have already been experiencing difficult times, given the cost-of-living crisis and the impact of Covid, he said, leaving neither parents nor the schools with “capacity to absorb additional costs”. “So in many cases, there’ll be schools that simply won’t be able to continue to operate,” he added.

Among the “smaller, more financially fragile schools”, he said, were often those “with the strongest religious characters”. Many of these, he said, had relatively low fees when compared with others and parents were often already under financial pressure in sending their children there.

He suggested independent education was often regarded as something restricted to the elite, but often private faith schools were fulfilling a need not met within the state sector. “We’re worried about what that means effectively for religious freedom,” he said.

It was a sentiment echoed by Raisel Freedman, assistant director of the Partnership for Jewish Schools, who said more than half of Jewish schools in the country were independent.

“Their fees are nowhere near the ranges you would get in some of the Etons of the world,” she said. They usually ranged between £5,000 and £10,000 a year.

In some cases, such schools were a family’s only choice because they were “the only school that caters to their unique religious needs”.

The introduction of VAT would force many to withdraw their children from private education — but without any places to cater for them in the state system, she said. The impact on the public purse would be “quite extreme”.

Parents who sent their children to private Muslim schools would also feel the pinch, according to Ashfaque Chowdhury, who chairs the Association of Muslim Schools. He said there were about 150 independent Muslim schools, where average annual fees were about £3,000.

The introduction of VAT would put most of these schools “in a very, very difficult position”, he said. If push came to shove, this could mean about 30,000 pupils shifting to the state sector — where there were currently no places for them.

Others have another fear about how a Labour government might impact on religion and education. Earlier this year the government initiated a consultation on lifting the 50 per cent cap on faith schools — which limits the number of places that can be given to children from a particular denomination. But will there be a U-turn if Labour gets into power?

That was a concern strongly expressed by Professor John Lydon and Dr Caroline Healy of the Catholic Union who have long campaigned for a change in the law. “We were particularly pleased that it was about to be lifted, especially in the context of parental rights,” Professor Lydon said. “We saw it as discrimination.”

Steve Chalke is a Baptist minister and founder of the Oasis Trust, which runs 54 state schools. None of those under the Oasis umbrella was designated as a faith school, he said, but “that does not mean that faith isn’t very, very, very important”. In fact, he said, it was the “central plank on which they’re built” and that “inclusion is part of whom we’re called to be as a Christian organisation”.

One area, Mr Chalke believed, that could be particularly hard hit by the introduction of VAT were parents of children with special educational needs. In his experience, many parents of children with complex needs had little choice but to opt for private education because class sizes were smaller and special help was given. In these cases, parents often make tough sacrifices to pay school fees which were “crippling them in other ways”.

“If Labour is intent on this policy, what we have to do is resource the state system … before removing and tampering with anything else,” he said.

One way to add resources to the state sector would be to invest in teachers. “We are so under-resourced in the state sector already — how are we going to deal with any more pressure?” Mr Chalke asked.

Deborah Weston, an experienced teacher and representative on the National Association of Teachers of Religious Education (NATRE), said there was a “serious issue” for recruitment and retention of teachers across all subjects, but this had long been a problem for RE. She said 51 per cent of teachers who delivered RE now actually spent most of their time teaching another subject in which they were trained.

“We have a massive shortage,” she said, and the number of graduates coming through in this area was not enough to fill the gaps in the profession. “We can’t wave a magic wand and find these teachers from nowhere.” The answer, she believed, was to create an “expert workforce” of teachers with specialist training.

At the start of the debate Paul Bickley, head of political engagement at the Theos think tank, said its research showed education was not regarded as a “key election priority issue” that voters considered when heading to the polls. Instead, they tended to focus on the economy, the NHS and immigration.

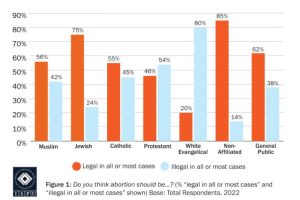

Theos data also revealed how satisfied different groups have been with the current government’s approach to education. He said the “most enthusiastic” group was Muslim, where 16.7 per cent said they were content. The least satisfied were the “nons” of whom only 7.9 per cent approved.

If education was not considered of top importance, “universities are even lower on the priority list,” according to Dr Tim Hutchings, from Nottingham University. He said universities were regarded as a “negative force” by right-leaning parties who wanted to do away with many degree courses.

Agreeing, Dr Lois Lee of the University of Kent said there were concerns about “woke universities” and that “small courses that don’t lead to good jobs”. The humanities, and specifically religious studies, were “really in the firing line”, she said.

“I speak as someone who’s been on the sharp end of that at the University of Kent, where philosophy, religious studies and anthology programmes have just been closed.” Having said that, Dr Lee said the education system might need to move with the times as religious affiliation declines.

If predictions of a Labour landslide are correct, she said, “we’re looking to have our first atheist prime minister” in Keir Starmer. “And that’s significant. It’s not a story of religious decline, which is how we tend to think of it, it’s a story of worldview change, and it means that our institutions need to make better space for expertise and worldviews more broadly.”

View the briefing on our YouTube channel here.